happygamestation.online

Market

How Home Equity Works

A maximum of three active Fixed Rate Options are permitted on a Home Equity Line of Credit. Property insurance is required. Other restrictions may apply. Home equity equals the value of your home that you own after deducting your current mortgage balance. · You can use home equity when you need a financial. Equity in a home means that the value of the home is worth more than the homeowner owes on the home. Many homeowners think of equity as it pertains to selling. A HELOC works something akin to a credit card where you can borrow based on your credit limit as often as you need to. A home equity loan, which is disbursed to you in a lump sum. · A home equity line of credit (HELOC), which is a revolving credit line that works like a credit. How does a home equity loan work in Texas? A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a. A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. Home equity loans, or second mortgages, allow homeowners to borrow against the equity in their homes. A borrower takes a lump sum of money and repays it in. A home equity loan is akin to a mortgage, hence the name second mortgage. The equity in the home serves as collateral for the lender. A maximum of three active Fixed Rate Options are permitted on a Home Equity Line of Credit. Property insurance is required. Other restrictions may apply. Home equity equals the value of your home that you own after deducting your current mortgage balance. · You can use home equity when you need a financial. Equity in a home means that the value of the home is worth more than the homeowner owes on the home. Many homeowners think of equity as it pertains to selling. A HELOC works something akin to a credit card where you can borrow based on your credit limit as often as you need to. A home equity loan, which is disbursed to you in a lump sum. · A home equity line of credit (HELOC), which is a revolving credit line that works like a credit. How does a home equity loan work in Texas? A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a. A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. Home equity loans, or second mortgages, allow homeowners to borrow against the equity in their homes. A borrower takes a lump sum of money and repays it in. A home equity loan is akin to a mortgage, hence the name second mortgage. The equity in the home serves as collateral for the lender.

To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. A home equity loan — sometimes called a second mortgage — is a loan that's secured by your home. You get the loan for a specific amount of money and it must be. What is a HELOC Loan? A HELOC, though also secured by your home, works differently than a home equity loan. In this type of financing, a homeowner applies for. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. Think of home equity as an asset you can use for other financial purposes – whether that's investing, renovating or moving house. You can buy back your equity at any time within a year term with no penalty. You maintain complete control over your home. You decide when to exit: When you. Loan providers offer the maximum loan amount of up to 80% or 85% on your home equity. So, if your home's market value has increased or you are left with a. Home equity line of credit · Borrow, repay and borrow again without reapplying. · This line of credit comes with a variable APR.² · Interest-only options. Typically, you will need a score of or better and no more than 45% in debt to income. A home equity line of credit, also known as a HELOC, is a revolving. The repayment period is usually 10 or 20 years. Learn more about how a home equity line of credit works. What is a home equity loan? A HELOAN resembles. How a home equity loan works. Home equity loan funds are disbursed in one lump sum and you repay the money in equal monthly installments. Interest rates for. A home equity loan lets you borrow money against the value of your home's equity to pay for things like home renovations and college educations. A home equity loan is a second mortgage on your home, with the equity in your home being the collateral on the loan. Your home equity is the difference between your property's market value and the balance of your mortgage. To find out how much equity you have, take the current market value of your home and subtract any liabilities, such as the mortgage. The difference is your. A home equity line of credit (HELOC) allows homeowners to leverage the equity they have already built in their homes. Because homes are among the most. Most states cap HELOC rates at 18%, but they can adjust monthly. Know how the adjustment structure works. Remember that the interest rate you are quoted when. A home equity loan allows homeowners to borrow against the equity in their home. Learn what a home equity loan is, how it works, pros and cons, and more. With a home equity loan, you'll get a lump sum payment that you can use to consolidate debt or finance purchases. Here's what you should know about home.

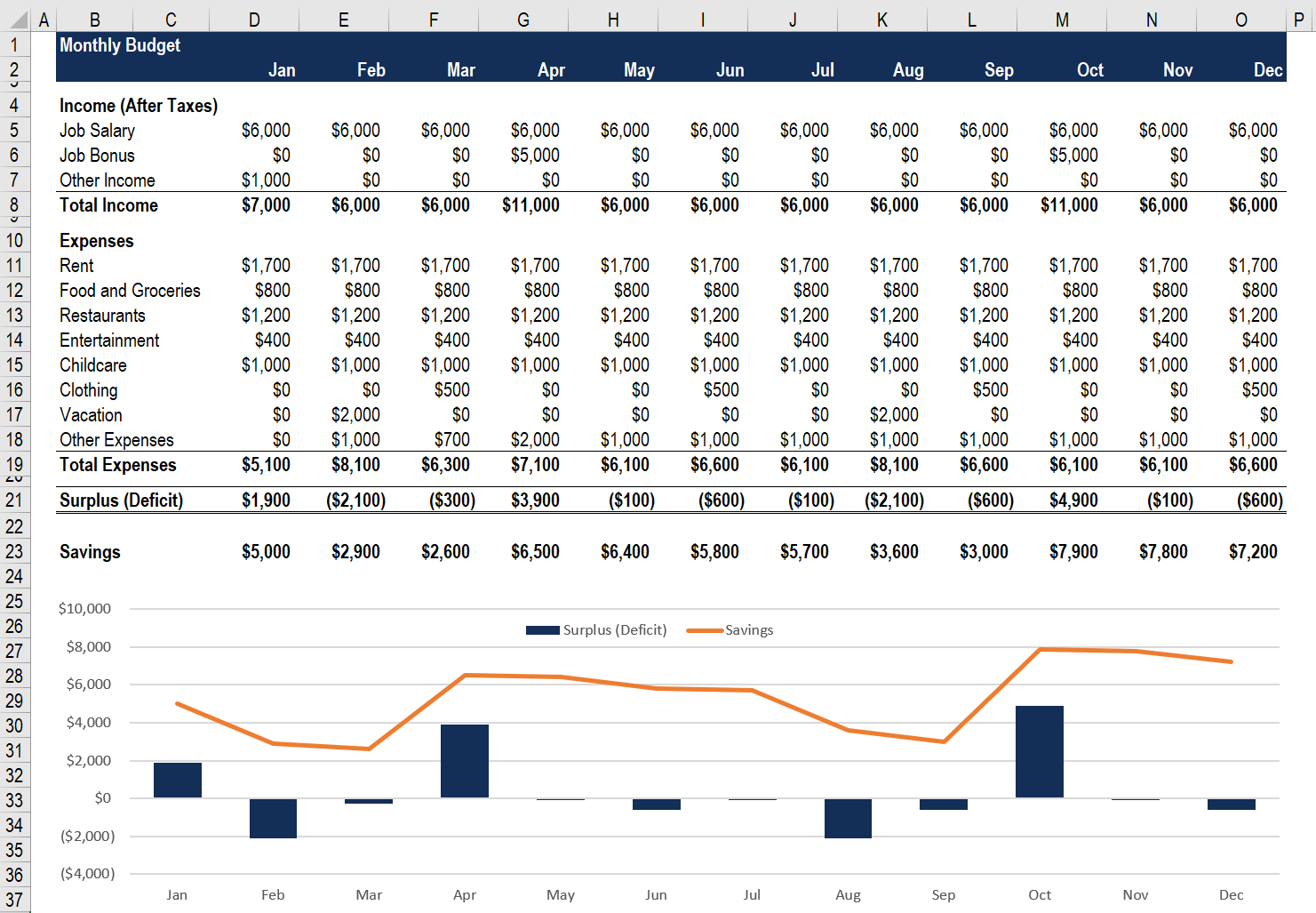

Financial Spreadsheet Example

16 Personal Finance Excel Spreadsheet Templates for Managing Money · 1. Money Management Template · 2. Personal Monthly Budget Worksheet · 3. College Budget. 2. Household Budgeting Spreadsheet. This user-friendly Excel family budget template has just the right amount of features to help you get your budget in order. Gain control of your finances by downloading and using one of these free monthly budget templates for a plethora of scenarios. If you need an all-in-one budgeting tool or want to monitor and improve your financial health, this Monthly and Annual Budget template is your go-to option. Bold Minimalistic Monthly Budget Tracker Sheet Financial Planner. Planner by Incomes & Expenses Planner Template | Elegant Minimalist Finance Planner. The spreadsheet you know with the power of a database and project management system. Gantt, Calendar, Kanban, Forms, and Automations. Get started free. This free, printable template provides a detailed income and expense tracking chart where you enter items such as fixed and variable expenses, debt and savings. Start Simple · The Budget Mom's Budget Packet · Google Sheets · Microsoft Excel · Vertex42 · Tiller · You May Also Like. Download free project budget templates in a variety of formats, and learn about the importance of project budgeting. 16 Personal Finance Excel Spreadsheet Templates for Managing Money · 1. Money Management Template · 2. Personal Monthly Budget Worksheet · 3. College Budget. 2. Household Budgeting Spreadsheet. This user-friendly Excel family budget template has just the right amount of features to help you get your budget in order. Gain control of your finances by downloading and using one of these free monthly budget templates for a plethora of scenarios. If you need an all-in-one budgeting tool or want to monitor and improve your financial health, this Monthly and Annual Budget template is your go-to option. Bold Minimalistic Monthly Budget Tracker Sheet Financial Planner. Planner by Incomes & Expenses Planner Template | Elegant Minimalist Finance Planner. The spreadsheet you know with the power of a database and project management system. Gantt, Calendar, Kanban, Forms, and Automations. Get started free. This free, printable template provides a detailed income and expense tracking chart where you enter items such as fixed and variable expenses, debt and savings. Start Simple · The Budget Mom's Budget Packet · Google Sheets · Microsoft Excel · Vertex42 · Tiller · You May Also Like. Download free project budget templates in a variety of formats, and learn about the importance of project budgeting.

Microsoft Excel isn't all about complex formulas. These free budget templates are an easy way to get an overview of your cash flow (monthly expenses versus. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. Using our annual budget spreadsheet can help you to manage you income and expenses and budget more effectively. Our budget planner looks at your monthly. Detailed yearly budget report template with a monthly breakdown of income and expenses for sales,. Yearly Business Budget Template. PERSONAL MONTHLY BUDGET TEMPLATE. Personal Monthly Budget Template. A, B, C, D, E CLICK HERE TO CREATE PERSONAL MONTHLY BUDGET TEMPLATES IN SMARTSHEET. Google Sheets budget spreadsheets. Under Google Sheets budgets are Best-Personal-Budget-Planner, Simple Budget Planner, and Yearly Budget Template. 5. CFI's. The spreadsheet you know with the power of a database and project management system Analyze, model, and budget. Use the same familiar features, functions, and. First, you can add or remove categories based on your unique income and expenses. You can also adjust the formatting to make the spreadsheet easier to read and. Personal Budget Spreadsheet. Yearly budget worksheet for planning your personal budget. Includes categories for a single person budgeting needs. Ideal for. Jumpstart your plan to grow with our library of free financial Excel templates. Templates are available to everyone—all you need to get started is a copy of. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. If not, have you looked at using the budget template Excel offers in the new workbook dashboard? Budget Templates - A yearly budget planner with more categories including child care and other family expenses. - Yearly budget planner with categories for. Create Your Budget. A, B, C, D, E, F, G. 1. 2, MONTHLY BUDGET WORKSHEET. 3, Enter your monthly income (Incoming Money), expenses (Outgoing Money) and savings . 50 excel templates to manage finances, cash flow, investments, and more. Balance sheets and financial statements, calculators and trackers, budget, loan. Excel Spreadsheets · Capital Budgeting Analysis (xls) - Basic program for doing capital budgeting analysis with inclusion of opportunity costs, working capital. The wedding budget planner template is designed to make planning of your wedding easier and less stressful, contains comprehensive list of things that you might. 6 Free Budget Template Spreadsheets · Best yearly budget template: Vertex42 · Best monthly budget template: Vertex42 · Best weekly budget template: Spreadsheet Budget · 1. First, enter the different type of income and expenses in column A. · 2. Enter the word Jan into cell B2. · 3. Enter some data. · 4. Enter the SUM. Excel Finance Templates. 50 excel templates to manage finances, cash flow, investments, and more. Balance sheets and financial statements, calculators and.

Who Makes Amana Dishwashers

The also make Roper. Kitchen Aid, Amana, Jenn Aire, and Maytag. There probably another dozen brand names spread around the world. This energy efficient Amana Dishwasher has a soothing 64dBa sound rating and the place-setting capacity ensures cleanup is done in a single cycle. Featuring a slate gray plastic tub, this Amana® Dishwasher helps you clean away crumbs and messes thanks to the Triple Filter Wash System. Visit Leon's for the best Amana home appliances at guaranteed low prices. We offer unmatched selection & fast, reliable shipping. Our brands — Amana®, Whirlpool®, Maytag®, KitchenAid® and JennAir® — have become trusted household names that live under the Whirlpool Corporation umbrella. A Fully Integrated Console with LED Display makes choosing cycles and Steel Fill Hoses for Dishwashers. $ Delivery Services. Free Local Delivery. Major appliances limited to washers, dryers, refrigerators, ranges, cooktops, wall ovens, microwaves, dishwashers, hoods, freezers, beverage & wine centers, ice. Amana has since expanded into manufacturing a variety of other appliances, including furnaces, ovens, countertop ranges, dishwashers, and clothes washers and. Featuring a slate gray plastic tub, this Amana® dishwasher helps you clear off every crumb, thanks to the Triple Filter Wash System. The also make Roper. Kitchen Aid, Amana, Jenn Aire, and Maytag. There probably another dozen brand names spread around the world. This energy efficient Amana Dishwasher has a soothing 64dBa sound rating and the place-setting capacity ensures cleanup is done in a single cycle. Featuring a slate gray plastic tub, this Amana® Dishwasher helps you clean away crumbs and messes thanks to the Triple Filter Wash System. Visit Leon's for the best Amana home appliances at guaranteed low prices. We offer unmatched selection & fast, reliable shipping. Our brands — Amana®, Whirlpool®, Maytag®, KitchenAid® and JennAir® — have become trusted household names that live under the Whirlpool Corporation umbrella. A Fully Integrated Console with LED Display makes choosing cycles and Steel Fill Hoses for Dishwashers. $ Delivery Services. Free Local Delivery. Major appliances limited to washers, dryers, refrigerators, ranges, cooktops, wall ovens, microwaves, dishwashers, hoods, freezers, beverage & wine centers, ice. Amana has since expanded into manufacturing a variety of other appliances, including furnaces, ovens, countertop ranges, dishwashers, and clothes washers and. Featuring a slate gray plastic tub, this Amana® dishwasher helps you clear off every crumb, thanks to the Triple Filter Wash System.

Amana washers make it easy to get the job done right. Shop Washers Amana dishwashers allow you to spend less time at the sink. The story of the Amana brand began in with George C. Foerstner, who founded Amana Refrigeration, Inc., taking its name from its city of origin, Amana, Iowa. Amana Built-In Dishwasher WHITE · Say "so long" to prerinsing your dishes. · The wash water is filtered through a very fine mesh to keep food particles from. Featuring a slate gray plastic tub, this Amana® dishwasher helps you clear off every crumb, thanks to the Triple Filter Wash System. Amana is actually a rebranded whirlpool. It's good quality for the cost. I own a front loading dryer that came with the house I bought 7 years ago. Featuring a slate gray plastic tub, this Amana Dishwasher helps you clean away crumbs and messes thanks to the Triple Filter Wash System. A combination of. makes sure water is hot enough to activate detergent; High Temp Rinse option makes sure water is hot enough for spot-free dishes; Delay Start -- choose a 2, 4. Shop Amana Built In Dishwasher Type Built In Dishwashers ADBAMB Amana 24 Inch Dishwasher with Triple Filter Wash System Black. ADBAMS (Dishwashers - Front Controls). Featuring a slate gray plastic tub, this Amana® Dishwasher helps you clean away crumbs and messes thanks to the. The Amana Dishwasher runs for about $ so it's in a very reasonable price range. I. The Amana Corporation is an American brand of household appliances and was founded just around the same time that we opened our store in Red Bank in Amana. Browse our online aisle of Amana Dishwashers. Shop The Home Depot for all your Appliances and DIY needs. Amana ADBAGS (Dishwashers - Front Controls). Contact Us For Price This Amana® electric range makes delicious meals, without difficult clean-up. Eco Series. Designed with efficiency in mind. Saving you water, energy and money with quality wash and dry performance.*Compared to dishwashers meeting the. The Triple Filter Wash System helps you skip the pre-rinse so you can spend less time scrubbing. ENERGY STAR® Certified. Amana® dishwashers Makes baking and. This Amana® dishwasher features the SoilSense Cycle to automatically adjust A Fully Integrated Console with LED Display makes choosing cycles and. Featuring a slate gray plastic tub, this Amana® dishwasher helps you clear off every crumb, thanks to the Triple Filter Wash System. A combination of three. Shop for Amana dishwashers in the appliance store at RC Willey. Find the perfect dishwasher in Utah, Idaho, Nevada, and California. The quick wash cycle makes the Amana dishwasher perfect for busy households who need quick and efficient cleaning, while the automatic temperature controls. Some of our featured brands are Amana, Bertazzoni, Bosch, Electrolux, Fisher Paykel, Frigidaire Professional, GE, Kamado Joe, KitchenAid, LG, Maytag, Scotsman.

How To Build A Savings Account Fast

Both recommend allocating money monthly to regular monthly bills, discretionary spending, and an emergency fund in a high-yield savings account. All of these. Create a budget. · Sell unwanted household items or clothing. · Pay off existing debt. · Set concrete goals. · Set up automatic bank account transfers. · Track your. Sometimes the hardest thing about saving money is just getting started. This step-by-step guide can help you develop a simple and realistic strategy. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Deposit a portion of your income in a savings or retirement account. Don't accumulate new debt, and pay off any debt you currently have. Establish a. Some institutions will require you to hold a minimum balance to receive the highest rate. Other banks might have you set up a checking account and have a. It's far easier to monitor your progress if you open a goal-specific savings account, where you can set up automatic transfers. That way you remove the. 1. Have a goal. Set up recurring transfers. · 2. Bank your bonus. Try to resist the temptation to spend an unexpected windfall like a bonus. · 3. Earn interest on. Set up an auto transfer from your checking account to your savings account each payday. Whether it's $50 every two weeks or $, don't cheat yourself out of a. Both recommend allocating money monthly to regular monthly bills, discretionary spending, and an emergency fund in a high-yield savings account. All of these. Create a budget. · Sell unwanted household items or clothing. · Pay off existing debt. · Set concrete goals. · Set up automatic bank account transfers. · Track your. Sometimes the hardest thing about saving money is just getting started. This step-by-step guide can help you develop a simple and realistic strategy. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Deposit a portion of your income in a savings or retirement account. Don't accumulate new debt, and pay off any debt you currently have. Establish a. Some institutions will require you to hold a minimum balance to receive the highest rate. Other banks might have you set up a checking account and have a. It's far easier to monitor your progress if you open a goal-specific savings account, where you can set up automatic transfers. That way you remove the. 1. Have a goal. Set up recurring transfers. · 2. Bank your bonus. Try to resist the temptation to spend an unexpected windfall like a bonus. · 3. Earn interest on. Set up an auto transfer from your checking account to your savings account each payday. Whether it's $50 every two weeks or $, don't cheat yourself out of a.

Consider using a basic savings or money market account. · Look for an account that pays you back. · Save enough to cover three to six months of expenses. · Start. Set up automatic transfers to your savings account each payday to save consistently. Becoming purposeful can help you build good financial habits. You can. We want to help you build savings fast, so you're free to make deposits anytime with this account. Although you won't get an ATM card, you'll get quick access. If you transfer money from Apple Cash, the funds are typically available instantly. If you transfer money from a linked external bank account, it will generally. 1. An emergency fund is a must. · 2. Establish your budget. · 3. Budget with cash and envelopes. · 4. Don't just save money, save for your future. · 5. Save. Also, consider a local credit union with fewer branch locations for your savings. The goal is to make the money less convenient to access in the hopes that the. Get Banked! · Start your financial journey · Why bank? · Keep your money safe · Pay bills easily · Save on fees · Build your financial reputation · Get more services. Understand your finances · Define your savings goals · Create a budget · Manage your debt · Open a savings account · Our top picks for savings accounts · Reduce your. Building a savings account can be tough. In a world of instant gratification, it's easy to lose sight of our long-term goals. You might be just getting. With a number in mind for your down payment, you can create a car-savings fund to help you manage the money you save. To save money and get closer to your goal. An online savings account is a great way to grow your money faster. Unlike a transaction account, you can't spend money directly from a savings account. So. The trick is to automatically transfer a set amount into your savings before you spend money on anything else. This way, you won't miss the money and your. Use a savings or other type of account that you can't access easily, unlike a checking account. Chances are you won't miss it. And don't watch the account. By making some small changes to your everyday life, you can easily reach your financial goals. Ultimate Guide to Saving Money. 1. Set Savings Goals. Why is. For every unnecessary purchase you make, consider adding half the cash value of that purchase to your savings account. Not only will this help your savings grow. Boost your savings · 1. Take the 1p savings challenge · 2. Try a 'no spend' weekend · 3. About to splurge? · 4. Put strangely-shaped veg in your supermarket trolley. We're leading the way to financial freedom. Our Forward Suite of Savings share these features in common, making it easy to save and watch your money grow. Save Faster. Use automated transfers to build your savings faster. Get Paid Two Days Early. Early Pay2 is free and available on savings accounts with direct. Take advantage of the options available to you, whether that's an employer-sponsored retirement account or an IRA. Make sure you have assets that can be easily. Savings accounts offer higher interest rates than standard bank accounts. The amount of interest you can earn depends on the account you choose and whether you.

How To Help Someone With Family Problems

There's nothing like family. The people we're related to by blood and marriage are expected to be our closest allies, our greatest sources of love and support. Health benefits of social interaction. Being social and spending time with others: 1. Helps you cope with stress. People who spend time with family and friends. Set and maintain boundaries. Strong, clear boundaries can protect you from toxic family interactions. Imagine you and your spouse are about to visit overbearing. Decide your role in the relationship · Set (and stick to) boundaries · It's OK to take a time-out from a family member · Family drama is inevitable · Don't let your. Let's be real, sometimes it can feel impossible to know what to say or do to help someone who's grieving. We get it! So, we've put together some helpful texts. Family Lives is a national charity working with and for parents. They run a 24 hour confidential helpline for parents as well as an email support service. Other. 1. Schedule a time to talk as a group. Facing and overcoming family problems can seem impossible. When you work together, however, resolving family differences. While we would all prefer to get along well with our families, it is not always possible to do so. A psychologist can help you work through these issues. You. Speak to someone else like a friend or an adult you trust for support. They can help you to feel better. Stay calm. You can't control if someone else gets angry. There's nothing like family. The people we're related to by blood and marriage are expected to be our closest allies, our greatest sources of love and support. Health benefits of social interaction. Being social and spending time with others: 1. Helps you cope with stress. People who spend time with family and friends. Set and maintain boundaries. Strong, clear boundaries can protect you from toxic family interactions. Imagine you and your spouse are about to visit overbearing. Decide your role in the relationship · Set (and stick to) boundaries · It's OK to take a time-out from a family member · Family drama is inevitable · Don't let your. Let's be real, sometimes it can feel impossible to know what to say or do to help someone who's grieving. We get it! So, we've put together some helpful texts. Family Lives is a national charity working with and for parents. They run a 24 hour confidential helpline for parents as well as an email support service. Other. 1. Schedule a time to talk as a group. Facing and overcoming family problems can seem impossible. When you work together, however, resolving family differences. While we would all prefer to get along well with our families, it is not always possible to do so. A psychologist can help you work through these issues. You. Speak to someone else like a friend or an adult you trust for support. They can help you to feel better. Stay calm. You can't control if someone else gets angry.

Accepting personal differences, talking, having fun together and getting professional help are effective strategies through which many family problems are. Family Lives is a national charity working with and for parents. They run a 24 hour confidential helpline for parents as well as an email support service. Other. Faith involves “coming to know” God as a person. (John ) We do so first by absorbing God's thoughts through the Bible. We learn that he sees each of us and. Communicating with your parents and anyone else in your family is key. Make sure to keep in touch with everyone. Don't make anyone feel left out. Do not tell the person they're wrong · Do not talk too much · Do not try to solve their problem · Helpful things to say · Focus on their feelings · Active listening. Help your children understand what they did wrong. □ If you get really angry at your child, take a break. Ask someone to watch her for. someone in person. You can also look at the Organisations like Relate can help you get advice and support you might want about family problems. Try to build a support network of people you trust, like friends or a teacher. You might even find it useful to ask someone else to explain things to your. Stay calm. Even though it might be upsetting to hear that someone you care about is distressed, try to stay calm. This will help your friend or family member. How can you help? Show your loved ones that they can trust you to be listened to without judging their mental state or behavior. While discussing your concerns. Show trust and respect. Trust and respect between you and your friend or family member are very important – they help to rebuild and maintain a sense of self-. A family therapist can work with your entire family to build communication and problem-solving skills, while an individual therapist can offer you in particular. Fact Sheet: Family Problems · Different personalities clashing and disagreements over ways of doing things · Jealousy or fighting between brothers and sisters. Family Problems. Dealing with family turmoil can be one of the most REACT is an online video that explains how to help yourself or someone you. The Crisis Center of Tampa Bay is here to be a gateway where you can find possible solutions to help you in your relationship challenges. Encourage Someone to. Consider talking with a someone who can help you work through the issue in a constructive way. They can provide an objective perspective and. If you're worried that a friend is struggling emotionally, trust that instinct. Use the tips and tools below to help you recognize a problem, start a. If you're having family issues and problems, such as conflict, housing or safety concerns, help is available. Get in touch with a nationwide family service. So, identify the problem, understand the cause, and work on the solution. You can take help from a counselor, family coach, or some trusted people around you. If it is a family member or close friend you are concerned about, they might not want to talk to you. Try not to take this personally: talking to someone you.

How Much Does Gastric Bypass Cost With Insurance

Weight Loss Surgery Costs: Self-Pay ; Anesthesia, $1,, $ ; Psychological evaluation/testing, $, $ ; BLISCare insurance premium, $2,, $1, ; Total. Bariatric Procedure Costs · Modified duodenal switch - $22, · Bypass - $18, · Sleeve - $13, · Band removal - $7, This guide to gastric sleeve costs, financing, insurance coverage and more can help you plan and budget for the procedure, which costs $13, on average. The average cost of Roux-en-Y gastric bypass surgery is approximately $15, to $30,, but this is often covered by insurance providers. The cost of the. Gastric bypass surgery can cost anywhere from $15, to $35, in the US, depending on location, surgeon experience, and insurance coverage. Is sleeve. often requires a lengthy and complicated approval process. Here are some of the key steps you should take to obtain insurance coverage for weight loss surgery. A cost starting at $16, is probably realistic. Medicare, Medicaid, and some insurance providers may cover a portion of the weight loss surgery cost. If you. For all bariatric self-pay patients, the initial consultation is $ and is taken off of the package price for surgery. Out-of-Pocket Costs. If you are pre-. Learn how bariatric surgery coverage works with Medicare. Know if gastric bypass surgery & laparoscopic banding surgery costs are covered. Weight Loss Surgery Costs: Self-Pay ; Anesthesia, $1,, $ ; Psychological evaluation/testing, $, $ ; BLISCare insurance premium, $2,, $1, ; Total. Bariatric Procedure Costs · Modified duodenal switch - $22, · Bypass - $18, · Sleeve - $13, · Band removal - $7, This guide to gastric sleeve costs, financing, insurance coverage and more can help you plan and budget for the procedure, which costs $13, on average. The average cost of Roux-en-Y gastric bypass surgery is approximately $15, to $30,, but this is often covered by insurance providers. The cost of the. Gastric bypass surgery can cost anywhere from $15, to $35, in the US, depending on location, surgeon experience, and insurance coverage. Is sleeve. often requires a lengthy and complicated approval process. Here are some of the key steps you should take to obtain insurance coverage for weight loss surgery. A cost starting at $16, is probably realistic. Medicare, Medicaid, and some insurance providers may cover a portion of the weight loss surgery cost. If you. For all bariatric self-pay patients, the initial consultation is $ and is taken off of the package price for surgery. Out-of-Pocket Costs. If you are pre-. Learn how bariatric surgery coverage works with Medicare. Know if gastric bypass surgery & laparoscopic banding surgery costs are covered.

UPMC bariatric staff members are qualified to assess your insurance coverage for bariatric surgery. Figure out how much your surgery could cost with UPMC! Weight loss surgery costs between $15, and $25,, depending on the procedure you choose. The average cost of gastric bypass surgery is around $23, If the entire amount of the “out-of-pocket” has been met, your insurance should pay % of the surgery charges. If your insurance does not have bariatric. common insurance requirements ; laparoscopic sleeve gastrectomy. As low as $8, ; laparoscopic gastric bypass. As low as $17, (includes BLIS complication. If your insurance does not cover the cost and you're paying for the surgery yourself, total costs range from $18, to $24, for a primary (first-time). Price Transparency ; Bariatric Surgery – Gastric Bypass. -. $6, ; OAGB – Mini Gastric Bypass. -. $4, ; Gastric Banding – Lap Band. -. Gastric sleeve surgery: $16, to $20,; Gastric bypass surgery: $25, These fees cover surgery with one of our expert bariatric surgeons, plus many other. The average estimated cost of a gastric sleeve surgery or sleeve gastrectomy for a patient that does not have bariatric coverage is between $10, and $18, Weight-loss surgery costs typically range from $7, to $33, before insurance coverage. Your total expense depends on your chosen operation. Hurry up don't. Insurance covers gastric bypass surgery, but coverage can vary considerably between health insurance plans. It is important to check specific insurance policies. Situation #1: No Health Insurance Coverage (cash pay) ; Laparoscopic Roux-en-Y Gastric Bypass (LRnYGB) – $15, $5, surgeon fees; $1, anesthesia. Self-pay patients who qualify for vertical sleeve gastrectomy can take advantage of a special cash price of $12, This special price includes: Operating room. The average cost for the gastric bypass procedure ranges from $18, to $22,, while adjustable gastric banding surgery costs anywhere from $17, to. If you plan to pay out of pocket, a roux-en-Y gastric bypass costs approximately $19, while a sleeve gastrectomy or LAP-BAND surgery averages $17, to. Without insurance, the cost of a gastric sleeve procedure in America can range from $15, to $25, Prices can vary depending on the. If you are paying for the surgery outside of insurance, the costs of the procedure starts as low as $15, for the lap band, $15, for the lap sleeve. My insurance won't cover any weight loss procedures or products. Had to go out of pocket. Got a medical loan with a small interest rate, for the. For all bariatric self-pay patients, the initial consultation is $ and is taken off of the package price for surgery. Out-of-Pocket Costs. If you are pre-. While the cost of bariatric surgery and related lifestyle changes can be considerable, the good news is that most health insurance plans provide coverage.

Wayfair Credit Card 1800 Number

Wayfair credit card more than 3 years happygamestation.onliner customer care representatives have been confirming this over a phone call that the Wayfair account that is. If it has been more than 30 days since the date of delivery but the item has an eligible manufacturer's warranty or protection plan, please contact us for a. In order to cancel your participation, you must cancel your Account by calling us at (TTY/TTD: ). If you cancel your participation. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit. Call Customer Care immediately at (TDD/TTY: ). There is suspicious activity on my account. How do I report it? If you notice. Lease purchase plans made just for you, no credit required. Get the app today. call Mastercard. Credit card offers are subject to credit approval. Comenity® Mastercard® Credit Card Accounts are issued by Comenity Bank pursuant to. About Us. About Wayfair · Wayfair Professional · Careers · Gift Cards · Wayfair Credit Card · Investor Relations · Sell on Wayfair. Customer Service. My Orders. Use it just like a regular credit card. Apply now. Shop in some of Canada's Wayfair Logo · See more. Check out our offers! Visit our Offer Hub for the. Wayfair credit card more than 3 years happygamestation.onliner customer care representatives have been confirming this over a phone call that the Wayfair account that is. If it has been more than 30 days since the date of delivery but the item has an eligible manufacturer's warranty or protection plan, please contact us for a. In order to cancel your participation, you must cancel your Account by calling us at (TTY/TTD: ). If you cancel your participation. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit. Call Customer Care immediately at (TDD/TTY: ). There is suspicious activity on my account. How do I report it? If you notice. Lease purchase plans made just for you, no credit required. Get the app today. call Mastercard. Credit card offers are subject to credit approval. Comenity® Mastercard® Credit Card Accounts are issued by Comenity Bank pursuant to. About Us. About Wayfair · Wayfair Professional · Careers · Gift Cards · Wayfair Credit Card · Investor Relations · Sell on Wayfair. Customer Service. My Orders. Use it just like a regular credit card. Apply now. Shop in some of Canada's Wayfair Logo · See more. Check out our offers! Visit our Offer Hub for the.

Get a $15 statement credit by using your enrolled eligible Card to spend a minimum of $50 in one or more purchases online at happygamestation.online by 10/31/ Wayfair Credit Card. PayPal & PayPal Credit. Apple Pay. Wayfair Financing Customer Service. Open. Closes at PM. Mon - Fri: AM - PM. Sat. These third parties will collect the information necessary to effectuate your transaction with us, such as credit/debit card number, security/CVV code, and. If you want to request a paper copy of these disclosures you can call Wayfair Credit Card at and we will mail them to you at no charge. To pay for a Wayfair Credit Card, apply to the company Wayfair Credit Services team by using the following contact: How To Cancel Wayfair Order. Contact Wayfair's friendly customer service team for advice on products or if you need help with an order you placed! We're here to help over phone, chat. Wayfair Credit Card · Gift Cards. Connect With Us. facebook · instagram · twitter No matter who you are, Wayfair is a place you can call home. We're a. With global headquarters and an extensive network of logistics hubs and customer service Wayfair Credit Card · Gift Cards. Connect With Us. facebook. Get StartedIt's free - no credit card needed. featuredImage-g2-rating wayfair-blue glassdoor-blue zoom-blue shopify-blue ancestry-blue paycheck-blue. With Chase Ultimate Rewards, you can redeem the points you've earned for travel, experiences, merchandise, gift cards and even cash back. Wayfair Credit Card · Investor Relations · Sell on Wayfair. Customer Service. My Wayfair Accessibility Statement · Return Policy · Help Center · Product. Wayfair operates the call center for this phone number 24 hours, 7 days. The short answer is that you should call on a Saturday. Wayfair Credit Card. Be the first to know about our best deals! You will Call Us. Customer Service. Open. Closes at p.m.. Mon - Fri: a.m. Wayfair Credit Card · Wayfair Financing · Careers · Sell on Wayfair · Investor Contact Us. Quick Help. Call Us. Customer Service. Open. Closes at PM. Mon. Use your eligible card and get a statement credit within 14 business days. No coupons or codes required. Video Player is loading. Chase Offers video. MasterCard Logo AmEx Logo Apple Pay PayPal Logo Klarna Logo Afterpay Logo Wayfair Credit Card Contact Us. Quick Help. Call Us. Customer Service. Closed. Wayfair Credit Card · Wayfair Financing · Careers · Sell on Wayfair · Investor Relations · Advertise With Us · Locations. Customer Service. My Orders · My. Wayfair Credit Card · Promo Codes & Promotions · Updating Shipping on an Order Contact Us. Quick Help. Call Us. Customer Service. Open. Closes at PM. Apple Card offers up to 3% Daily Cash back on purchases with no fees. Apply with no impact to your credit score to see if you're approved. Terms apply. Please refer to the Activation page to redeem your gift card. If the gift card does not arrive within the expected time frame, contact Customer Service for.

Safest Way To Invest Large Sums Of Money

High-yield savings accounts · Certificates of deposit · Money market accounts · Treasury bonds · Treasury Inflation-Protected Securities · Municipal bonds · Corporate. We believe a better strategy for optimizing your net worth is to invest for cash flow, turn a lump sum into an income stream, then fund a long-term whole life. For most investors, we'd recommend a broad mutual fund or ETF that tracks an index of stocks such as the S&P Index funds offer some of the easiest and most. When deciding whether to invest a lump sum of money or smaller, regular instalments, you might reach your decision based on pound cost averaging. Dollar cost averaging. A way to invest by buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. · Market. If you don't trust yourself to not blow through the money and become a statistic, the best bet is to invest your money straightaway. While there. Pay off your debts · Open a high-interest savings account · Spread your spending over time · Invest your money. Should you have cash in your investment portfolio? · A yield-bearing savings account can be used for cash that you've set aside for an emergency or that you're. 7 best ways to invest a lump sum wisely · 28 March · 1. Pay off high interest debt · 2. Build an emergency fund · 3. Diversify your portfolio. High-yield savings accounts · Certificates of deposit · Money market accounts · Treasury bonds · Treasury Inflation-Protected Securities · Municipal bonds · Corporate. We believe a better strategy for optimizing your net worth is to invest for cash flow, turn a lump sum into an income stream, then fund a long-term whole life. For most investors, we'd recommend a broad mutual fund or ETF that tracks an index of stocks such as the S&P Index funds offer some of the easiest and most. When deciding whether to invest a lump sum of money or smaller, regular instalments, you might reach your decision based on pound cost averaging. Dollar cost averaging. A way to invest by buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. · Market. If you don't trust yourself to not blow through the money and become a statistic, the best bet is to invest your money straightaway. While there. Pay off your debts · Open a high-interest savings account · Spread your spending over time · Invest your money. Should you have cash in your investment portfolio? · A yield-bearing savings account can be used for cash that you've set aside for an emergency or that you're. 7 best ways to invest a lump sum wisely · 28 March · 1. Pay off high interest debt · 2. Build an emergency fund · 3. Diversify your portfolio.

By making regular investments with the same amount of money each time, you will buy more of an investment when its price is low and less of the investment when. Mutual funds are similar to ETFs. They pool investors' money and use it to accumulate a portfolio of stocks or other investments. The biggest difference is that. Many safe investments, like PPF or FDs, offer the benefit of compound interest, helping your money grow steadily over time. Tax Benefits*: Several safe. Investing a Large Sum of Money: What to Do, What NOT to Do, and How to Invest for F.I.R.E. · 3. Investing in the Stock Market · 2. Investing in Real Estate · 1. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available. 2. Invest for the long term (10+ years). Mutual funds are best suited for longer-term goals since short-term fluctuations even out over time. Investing small amounts of money on an ongoing basis can help smooth out returns over time and reduce overall portfolio volatility. Your monthly savings can. There are many different buckets you can fill with money, such as a Roth IRA, HSA, or taxable brokerage account. Each of these accounts serve a different. If you're looking for the best investments for large sums of money in real estate. I'd say think about housing whether it's single family homes or apartment. Low-risk investments and savings options include fixed annuities, savings accounts, CDs, treasury securities, and money market accounts. Of these, fixed. You could invest your $, in real estate, real estate investment trusts (REITs), stocks, or other securities. Thoroughly research your options and speak. Tips for managing lump sums · 1. Determine YOUR best savings strategy · 2. Spread your cash for maximum return and safety · 3. Consider a savings platform to help. We believe a better strategy for optimizing your net worth is to invest for cash flow, turn a lump sum into an income stream, then fund a long-term whole life. Invest It. Investing is a good way to build your wealth. You have a number of ways to get started. Financial advisors can help you build a diversified. These are an investment contract you have with a bank to pay you a guaranteed rate of return when you deposit money for a specified amount of time. CDs are. There are several short-term options open to investing your cash safely while you think things through and make plans. One method is to invest the entire lump-sum all at once. This is mathematically the best option. The other is to dollar cost average smaller amounts into the. Defensive investments ; Cash. Includes bank accounts, high interest savings accounts and term deposits. Used to protect wealth and diversify a portfolio. Average. I am considering writing a lengthy discussion on how to invest a large lump sum of money effectively. This topic comes up for discussion a LOT here on. Larger amounts of money increase the value of certain parts of financial planning, such as tax planning and tax-efficient investing, minimizing investment costs.

Learning Computer Coding

Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more. Khan Academy is a. Do You Want To Learn to Code? Try Our List of the + Best FREE Online Coding Classes to learn every programming language out there! Learn the technical skills to get the job you want. Join over 50 million people choosing Codecademy to start a new career (or advance in their current one). The Mimo coding app is an effective way to code in Python, JavaScript, HTML, TypeScript, SQL, and CSS. Our programming courses suit everyone. Get our code-. Use the MOOC Python Programming from the University of Helsinki. Free, textual, proper "Introduction to Computer Science" course, heavily. Online coding courses are a great way to learn programming skills fast. Learn about courses and careers in this growing field. Explore the world of computer science with engaging videos, self-paced tutorials, programming activities, and more for all ages and experience levels! The Best Programs for Learning to Code ; Best for Free Coding With Paid Options. Codecademy · Many free courses; Exercises include building real websites ; Best. Explore computer programming courses and programs. Build essential coding skills needed for front-end and back-end web development, machine learning, iOS and. Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more. Khan Academy is a. Do You Want To Learn to Code? Try Our List of the + Best FREE Online Coding Classes to learn every programming language out there! Learn the technical skills to get the job you want. Join over 50 million people choosing Codecademy to start a new career (or advance in their current one). The Mimo coding app is an effective way to code in Python, JavaScript, HTML, TypeScript, SQL, and CSS. Our programming courses suit everyone. Get our code-. Use the MOOC Python Programming from the University of Helsinki. Free, textual, proper "Introduction to Computer Science" course, heavily. Online coding courses are a great way to learn programming skills fast. Learn about courses and careers in this growing field. Explore the world of computer science with engaging videos, self-paced tutorials, programming activities, and more for all ages and experience levels! The Best Programs for Learning to Code ; Best for Free Coding With Paid Options. Codecademy · Many free courses; Exercises include building real websites ; Best. Explore computer programming courses and programs. Build essential coding skills needed for front-end and back-end web development, machine learning, iOS and.

Programming can be boiled down to modifying memory/data, enhanced by how well you understand the computer. It's sedentary perseverance, managing. Courses. 51 Courses · An Introduction to Programming Using Python · How to Get Into Blockchain · An Introduction to Cryptography · An Introduction to Logic for. This page will help you begin to learn programming and computer science, with some suggested introductory courses on OCW. Learn typed code through a programming game. Learn Python, JavaScript, and HTML as you solve puzzles and learn to make your own coding games and websites. Learn Coding Fundamentals in These 8 Steps · Step 1: Ask Yourself, “Why Should I Learn to Code?” · Step 2: Choose the Right Coding Tools and Software to Get. Instead of teaching a specific programming language, this course teaches programming fundamentals that can be helpful for any language you learn. A computer that offers official Linux support. The one feature that many coding beginners overlook is the quality of the keyboard. You are going to be typing. Learning to code provides kids with a creative outlet, academic foundations, and potential career skills. Explore the benefits and kid-friendly coding. 1. Code Yourself! · 2. Coding for Beginners 1: You Can Code!, Skillshare · 3. Microsoft Excel VBA Fundamentals: Learn Basic Coding Skills, Udemy · 4. Master the. Explore top courses and programs in Computer Programming. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey. 1. Research languages. 2. Choose a language. 3. Enroll in school, an online course, or coding bootcamp. 4. Utilize free online tools. 5. Read a book about the. Every student in every school deserves the opportunity to study computer science. Read on to learn about how people use code to communicate with computers and develop electronic devices, machines, and other technologies. How Does Coding Work? Learn various programming languages, coding techniques, and best practices. Skills you'll gain: Computer Programming, Javascript, Machine Learning. Hedy: textual programming made easy! Grades 2+ | Python, Hedy. Codi the Bee. Grades 6+ | Blocks. In short, coding isn't hard. However, like anything fresh, its not easy to start. It just takes more time than you might expect. To be a competent coder, you. coding easy to teach and fun to learn. Students learn collaboration and core computer science concepts as they create their own projects. Educators lead the. Python. Python is always recommended if you're looking for an easy and even fun programming language to learn first. Rather than having to jump into strict. Coding refers to the intercommunication process for us to give instructions for a computer or program to process our requests. It is widely used in our daily. A gentle introduction to programming that prepares you for subsequent courses in coding. This course introduces learners to Machine Learning Operations (MLOps).

Low Interest Balance Transfer Credit Cards

Balance transfer 0% introductory APR for first 12 billing cycles after account opening. After that, % variable APR based on your creditworthiness. There is. Cards like Citizens Clear Value® Mastercard® could be a top consideration if you want to transfer a balance. For instance, it offers an month 0% APR, which. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. The idea is that the transferred balance on the new credit card will accrue low or no interest during an introductory period—usually anywhere from 6–24 months. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Learn more about why you may end up paying interest on a zero percent APR card. 5 min read Aug 05, Female entrepreneur using smart. The U.S. Bank Visa® Platinum Card is an ideal no annual fee card for anyone who wants to save on interest for new purchases and balance transfers. Rewards. None. I know Discover cards are 0% APR for 18 months I believe, but they have a 3% balance transfer fee. Are there any balance transfer cards with $0 transfer fees? Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. Balance transfer 0% introductory APR for first 12 billing cycles after account opening. After that, % variable APR based on your creditworthiness. There is. Cards like Citizens Clear Value® Mastercard® could be a top consideration if you want to transfer a balance. For instance, it offers an month 0% APR, which. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. The idea is that the transferred balance on the new credit card will accrue low or no interest during an introductory period—usually anywhere from 6–24 months. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Learn more about why you may end up paying interest on a zero percent APR card. 5 min read Aug 05, Female entrepreneur using smart. The U.S. Bank Visa® Platinum Card is an ideal no annual fee card for anyone who wants to save on interest for new purchases and balance transfers. Rewards. None. I know Discover cards are 0% APR for 18 months I believe, but they have a 3% balance transfer fee. Are there any balance transfer cards with $0 transfer fees? Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer.

A balance transfer is a transaction in which you move debt from a high-interest credit card to a card with a lower interest rate, ideally one with a 0%. Low interest rates on balance transfer credit cards may help you catch up on debt payments, but these APRs don't usually last forever. If you're unable to pay. Enjoy 0% intro APR on balance transfers for the first 18 billing cycles after account opening with a TD FlexPay Credit Card. Unlock the features of your new. Transfer your credit card balance to Addition Financial and pay 0% APR for 12 months. You'll save big, plus get great extras, like Cash Back or Rewards. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Because we don't charge a balance transfer fee or annual fee, you can pay off your balance faster. Both of our credit cards offer competitive low rates, which. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. 10 partner offers · Citi Double Cash Card · Citi Rewards+ Card · Wells Fargo Active Cash Card · Citi Custom Cash Card · Blue Cash Everyday Card from American Express. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. Why we like it: The Chase Freedom Flex shines in the balance transfer category with its long intro APR period on balance transfers and purchases. This. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - %, based on your. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. BMO Platinum Credit Card · 0% introductory APR on purchases for 15 months from date of account opening. · 0% introductory APR on balance transfers for 15 months. The introductory rate may be as low as 0% and last anywhere from six to 18 months. The challenge: Transferring a balance means carrying a monthly balance, and. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. A balance transfer is a type of credit card transaction in which debt is moved from one account to another with lower interest rates. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Intro BT APR 0% intro APR for 18 months on Balance Transfers · Rewards Rate Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an.